Central’s New Stock Market Team Managing $100,000 in Investments

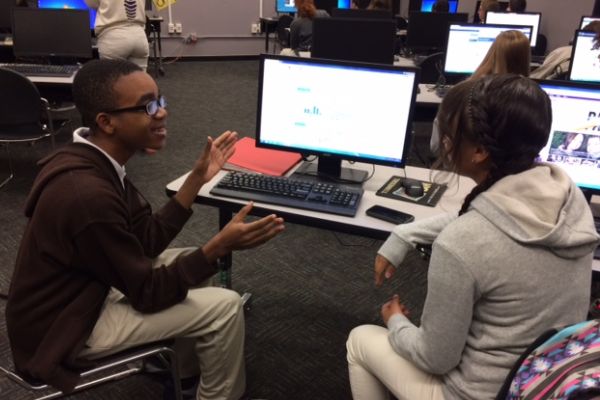

THE CENTRAL STOCK MARKET TEAM — Tenth grade, stock market team members, Christian Thomas and Edicklee Frias-Cruz converse about the rising and falling stocks of certain corporations.

November 1, 2016

Buying and selling stocks might not be something many high school students know much about, but at Central High School this year, a team of six students are learning how to manage in a real world economy, including all of the contributing factors that affect the stock price, as well as researching the current stock markets’ condition.

“The stock market is a place where people buy and sell shares of stock. A stock is a share or part of a company. When you buy a share of stock, your risk is limited to the amount you bought the stock for, whereas if you own your company, you are at risk for losing everything you invested in it plus some,” explains Danielle Hooper, the adviser for the Central Stock Market team. “They are located all over the world. The biggest ones in the United States are in New York; Nasdaq is an example.”

The Stock Market Game, the nationwide mock stock trading competition began in October, and Central High’s team is actively striving for success.

“Each group of participants are given $100,000 to invest in the stock market in any manner they wish. This is a 12 week competition within the state of Tennessee. A set time period is given and schools are free to join up until the end of the competition in the week of December 15. The students are competing against 58 other teams in their division/region,” said Hooper. “Since this is an online competition, at the website, www.stockmarketgame.org, students will not leave the school unless they win the regional.”

The students participating can communicate among themselves through their phones in order to discuss, contemplate, and make final decisions about which stocks may be the better risk to take.

“We do not physically talk to each other,” stated another sophomore participant, Christian Thomas. “We communicate through Messenger.”

There are three rounds in this competition, there are the districts, state, and the nationals. By winning the districts, winners are eligible for the state competition, the state winners become eligible for the nationals, and the national winners get a trip to New York.

“There is a Fall and Spring session, and each session is 12 weeks long. Schools can compete in either the Spring, Fall or both sessions,” commented Hooper. “I am hoping that Fall is a primer to doing well in Spring.”

Although there are no official requirements in order to be apart of the team, participants should hold an interest in the business world to some extent.

“I have an interest in business as a potential major in the future, so I decided to join the team in order to get an early start and experience the business world without my livelihood at stake,” explained a sophomore member of the Central Stock Market Team, Edicklee Frias-Cruz.

The students that participate in this competition have nothing to lose and much to gain including a valued principle in life: experience.

“Students are able to participate in a real world economy. The students will learn how to read stock information and look at how market conditions interact with the prices of stocks. Many things can cause a stock price to go up or down, and students will be looking for these factors. The students will be researching stocks and their companies,” construed Hooper. “Not only are students able to gain experience to further their knowledge and test their judgement, the students will also learn how to invest their hard earned money in the future.”

The stocks that are present in the online competition are the actual values in reality, but whatever stocks the students “buy” in the competition have no relation to the real stocks.

“The fundamentals of the stock market is that you select and invest in whatever stock(s) you think will increase and short the stocks that will decrease,” elaborated Christian Thomas.

The end of the Fall session is quickly approaching as winter impends the industrious students. The Central Stock Market Team is currently in the 23rd place, though the placement changes daily just as the stocks do.